kern county property tax rate 2021

2019-2020 Annual Property Tax Rate Book. What is the sales tax rate in Bakersfield California.

Fort Bend Central Appraisal District

While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected.

. We base our actions on common sense innovation the long-term view and craft positions based on adopted values. Kern County collects on average 08 of a propertys assessed fair market value as property tax. California has a 6 sales tax and Kern County collects an additional 025 so the minimum sales tax rate in Kern County is 625 not including any city or special district taxes.

Not sure what Supplemental Taxes are. The California sales tax rate is currently 6. P-1 Estimated Amount of Property Taxes Collected.

119-004 - SO KERN CO UNIFIED. Should you require additional information on how the taxes were calculated contacted the Office of the Auditor-Controller-County Clerk at 661 868-3599. P-1 Estimated Amount of Property Taxes Collected.

Net Total Taxable Value. Current tax roll values that are used to calculate the bills due in December 2021 and April 2022 Land Value. Go to Bill Details on Kern County Treasurer-Tax Collectors website.

Grouped Parcels - there will be 4. To our web site. Here you will find answers to frequently asked questions and the most commonly requested.

It is an honor and a privilege to have the opportunity to serve the taxpayers of Kern County. Kern County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. The total assessed value of all taxable property in the county as of January 1 2020 is valued 1022 billion a 28 billion increase over the prior year said the Assessors Office.

What is the sales tax rate in Kern County. The total sales tax rate in any given location can be broken down into state county city and special district rates. For questions about filing extensions tax relief and more call.

2020-2021 Annual Property Tax Rate Book. The Kern County sales tax rate is. Net Total Taxable Value.

The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. Workers Comp Rate 2020-21. This is the total of state and county sales tax rates.

082-006 - KERNVILLE UNION. This convenient service uses the latest technology to provide a secure way to bid on tax defaulted property. Kern County Sales Tax Rates for 2022.

Of the fifty-eight counties in. The median property tax also known as real estate tax in Kern County is 174600 per year based on a median home value of 21710000 and a median effective property tax rate of 080 of property value. Tax amounts are determined by the tax rates and values.

Welcome to the Kern County online tax sale auction website. The Kern County California sales tax is 725 the same as the California state sales tax. The State Controllers Property Tax Postponement Program allows homeowners who are seniors are blind or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including at least 40 percent equity in the home and an annual household income of 45000 or less among other requirements.

The California state sales tax rate is currently. Find Kern County Property Tax Info From 2021. Taxes are going up for many county residents but not all.

No deed shall be transferred to the purchaser if the property is purchased directly or indirectly by the current owner for lower than the minimum price determined pursuant to subdivision a. The Bakersfield sales tax rate is 1. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year.

KGET The Kern County Assessors Office announces the completion of the 2020-2021 assessment roll. Unduplicated Pupil Count Dec 2020. Annual Amount of Property Taxes Collected 2019-20.

DeedAuction is part of our offices ongoing effort to use technology. 2016-2017 Annual Property Tax Rate Book. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County.

Founded in 1939 KernTax is the guard dog protecting the interests of. Annual Amount of Property Taxes Collected 2020-21. The Kern County Sales Tax is collected by the merchant on all qualifying sales made within Kern County.

P-2 Estimated Amount of Property Taxes. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Bakersfield California is 825.

Did South Dakota v. 2018-2019 Annual Property Tax Rate Book. The County sales tax rate is 025.

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. KernTax is a member-supported 501 c 4 non-profit corporation with the mission to bring about more accountable effective efficient reliable local governments. 2021-2022 Annual Property Tax Rate Book.

Our mission is to collect manage and safeguard public funds to provide community services to the constituents of Kern County and we strive to do this in the most efficient and effective manner possible. The property tax rate in the county is 078. This estimator will assist taxpayers who have either recently purchased a property or those considering a purchase during the current fiscal year July 1st.

Tax rates include the general levy required by Article XIII of the State Constitution levies for voter approved debts and negative levies for monies to be returned under Section 100 of the Revenue and Taxation Code. 2017-2018 Annual Property Tax Rate Book. Workers Comp Rate 2021-22.

With easy access to tax sale information and auction results you can research properties and enter bids from anywhere in the world. 2015-2016 Annual Property Tax Rate Book. Total County property value increased by 265 from 6425 billion to 6595 billion between 2020 and 2021.

TAX RATES Tax rates are fixed annually no later than the third day of October by the Board of Supervisors. Tax Rates By City in Kern County California. Tax rates are calculated in accordance with Constitutional Article 13a and presented in percentage of value.

1788 rows Kern. The minimum combined 2022 sales tax rate for Kern County California is. Questions regarding tax bills should be directed to the Tax Collector at 661 868-3490.

Kern County has one of the highest median property taxes in the United States and is ranked 606th of the 3143 counties in order of. This years tax bills reflect the complexity of our property tax system said Assessor John Wilson.

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Property Tax California H R Block

Property Taxes By State County Lowest Property Taxes In The Us Mapped

5 Things To Know For This Year S Tax Season Ktla

Fort Bend Central Appraisal District

Kern County Ca Property Tax Search And Records Propertyshark

About The Grand Jury Kern County Ca

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Los Angeles County Ca Property Tax Search And Records Propertyshark

Property Taxes Leap In 2020 2021 Firsttuesday Journal

Which Cities And States Have The Highest Sales Tax Rates Taxjar

/what-difference-between-state-and-federally-chartered-credit-union_final-6d23ae652fc34b3d96a7ce26e31b4543.png)

State Vs Federally Chartered Credit Unions

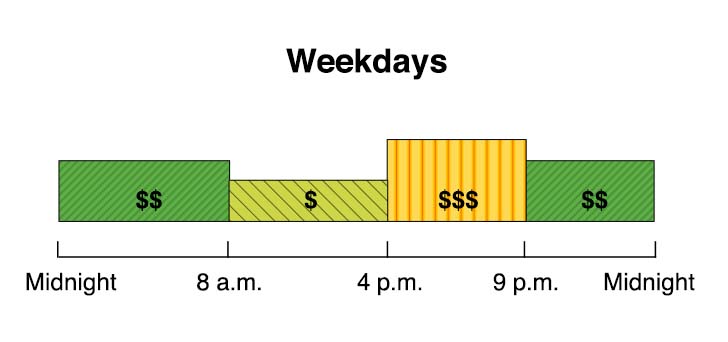

Business Time Of Use Rate Plans Rates Your Business Home Sce

Kern County Ca Property Tax Search And Records Propertyshark

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Kern County Ca Property Tax Search And Records Propertyshark

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Kern County Ca Property Tax Search And Records Propertyshark